I plead for a new, more general definition of liquidity suppliers in securities markets.

I propose

“He who trades against price pressures, supplies liquidity,”

instead of

“He whose price quote is taken by an incoming market order, supplies liquidity.”

If you actively bought during the Flash Crash, did you supply liquidity? The current definition says “No” because active buying means taking the ask quote of others.

The new definition says “Yes” as you bought when prices collapsed. You traded against what turned out to be a huge price pressure. The price was temporarily below fundamental value to accommodate a large seller’s desire to rid himself of a $4.2 billion position in twenty minutes (SEC, 2010).

The new definition makes more economic sense as by buying you were serving the large seller’s demand for immediacy. If you are an intermediary, the discount you got when buying compensates you for the price risk you run over this newly acquired inventory. Risk-averse agents need to be compensated for such risk (Grossman and Miller, 1988).

Should we care? Well actually yes, we should. There is a lot of debate on the role of various types of traders in securities markets, in particular high-frequency traders (HFTs). One of the main arguments in favor of HFTs is that they supply liquidity. But, do they? The answer might be different when comparing the outcome across the two definitions.

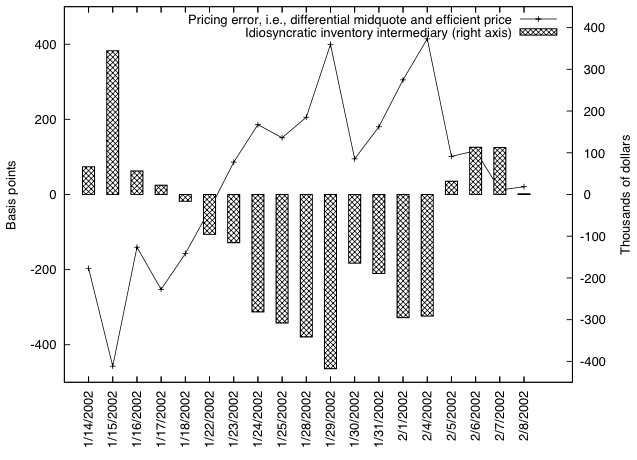

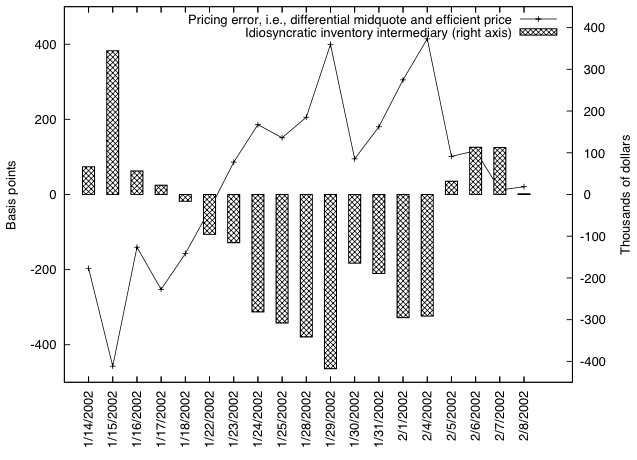

To apply the new definition one needs to identify price pressures. In a recent paper, Terrence and I propose a state-space approach. Perhaps the key graph in the paper is a plot of the NYSE specialist position against the identified price pressure or “pricing error” (Figure 1b):

The graph illustrates that, not surprisingly, the NYSE specialist supplies liquidity. He trades against price pressure. The paper goes a lot further and, for example, backs out his risk aversion coefficient through structural estimation.

One of the main takeaways of the paper is nevertheless that price pressures and liquidity supply are intimately linked. I believe regulators should identify liquidity suppliers as “contrarian” traders. More specifically, as those who trade against (temporary) pricing errors. The state-space approach could identify such errors, but there might well be alternative approaches.

You find the paper here.

P.S.: Note that the two definitions agree on who the liquidity supplier is in the early microstructure models (e.g., Roll, 1984). Absent an informational friction, if you actively sold a security by taking the bid quote of the “market maker,” this market maker bought it at a discount, i.e., a negative price pressure.