When high-frequency traders (HFTs) enter markets, the bid-ask spread declines. Several academic studies have reported such result. Investors pay less for each market order they send. All good and everyone happy.

Everyone?

Retail investors, probably. They can send all they want to trade in a single market order. Depth at the best price quote is large enough for them.

Institutional investors, not necessarily. They trade large orders that need to be sliced into small pieces and sent to the market sequentially. They care about incremental price impact, not about the half-spread they pay on a single market order. Ideally, intermediaries lean against their order in the course of its execution. Price impact is minimized that way. Institutional investors worry about the opposite behavior: HFTs who “front-run” them and increase their price impact.

Lots of talk, but do we have any facts?

Today Vincent van Kervel and I release a study that aims to fill the void. We studied how the top-ten HFT firms collectively traded around the orders of four large institutional investors (names below). We analyzed 5,910 orders. A single order led to 135 child trades on average. The data pertains to trading in Swedish blue chip stocks in 2011-2013.

We ask two questions:

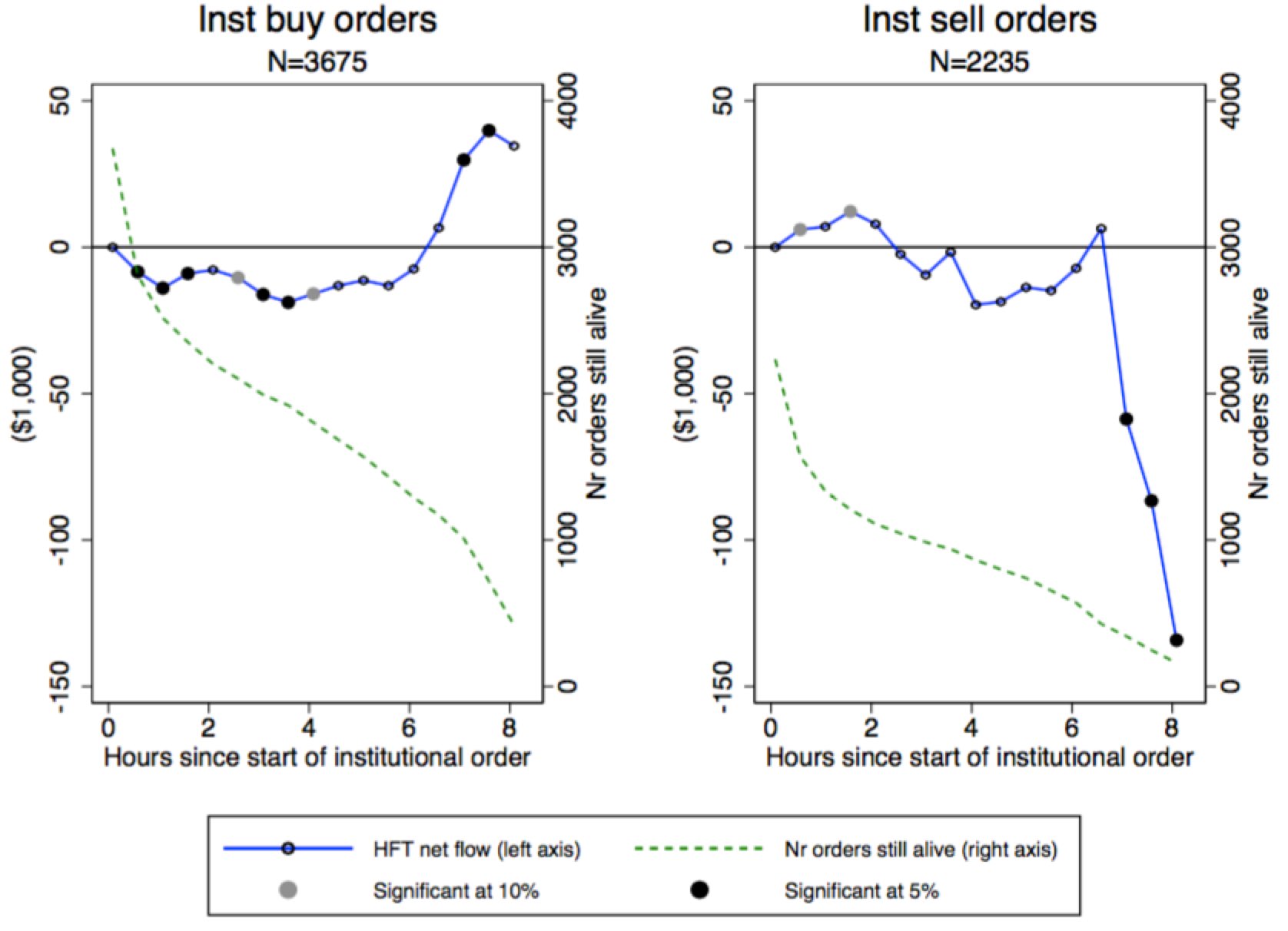

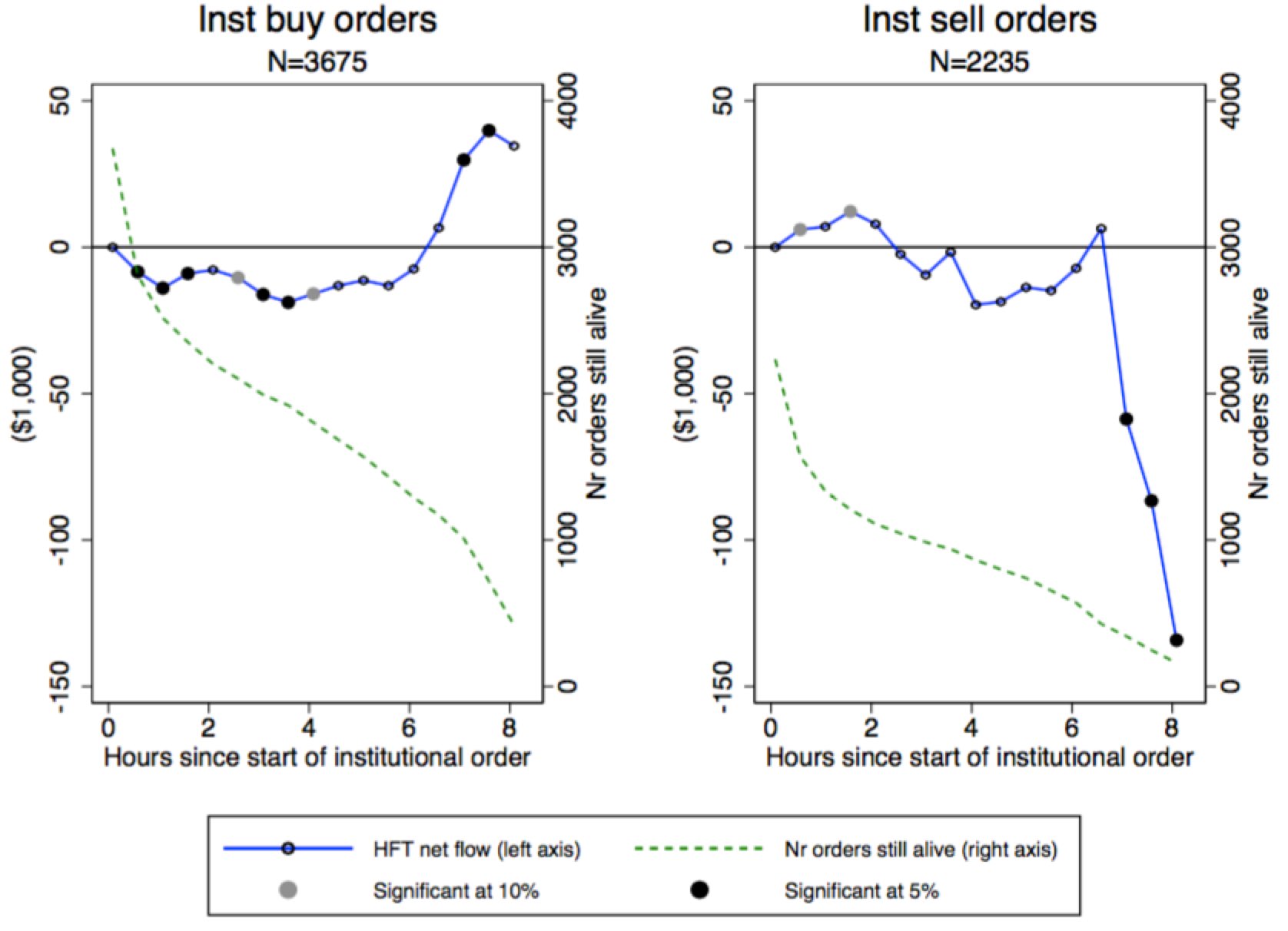

Two graphs were taken from the report to illustrate the answers. The first one plots the average HFT net flow (buy minus sell volume) in the lifetime of the orders.

The graph shows that initially HFTs lean against an order. They sell for institutional buy orders and they buy for institutional sell orders. If the order, however, takes hours to execute HFTs eventually turn around and seem to go with the order.

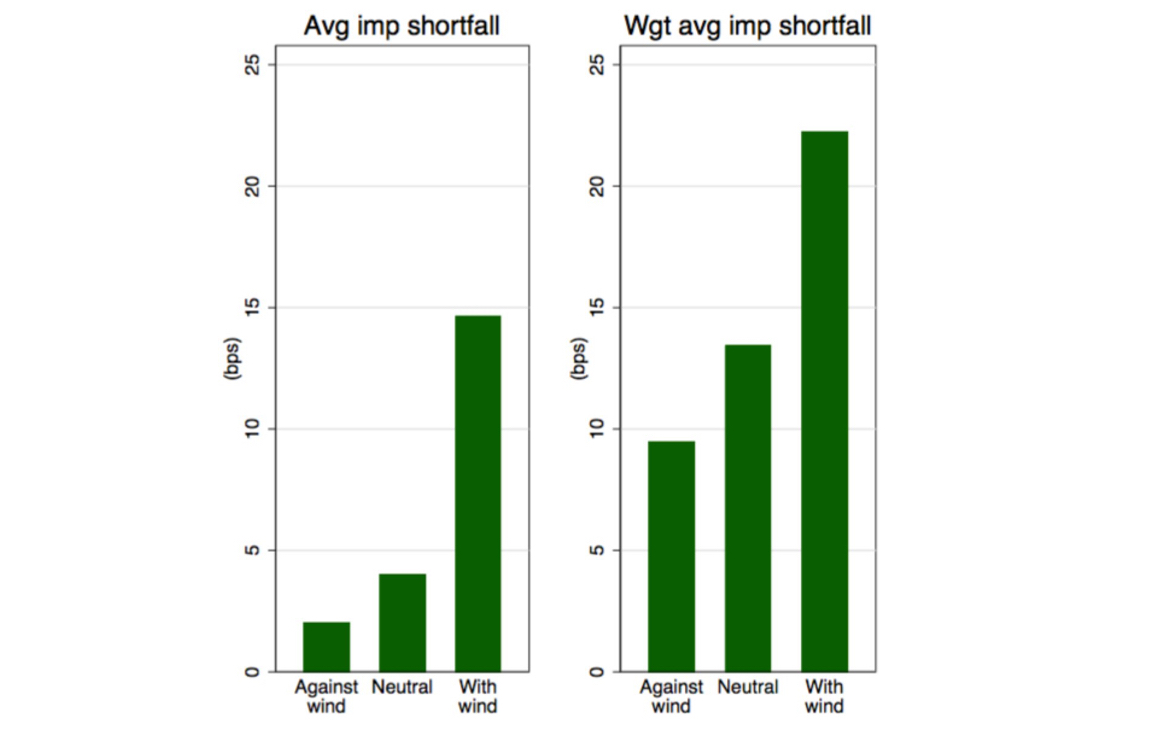

Should institutional investors care? A standard measure for their transaction cost is “implementation shortfall.” For a buy order it is defined as the average trade price minus the price that prevailed at the time it began executing. This difference is expected to be positive as repeated buying typically drives the price up. For sell orders it is defined as the starting price minus the average trade price. For the next graph, we first sort orders into terciles based on whether HFTs leant against the order, were more or less neutral, or went with the order. If one then calculates the average implementation shortfall for each tercile, the following plot emerges.

It suggests that, yes, institutional investors should care. For example, their order-size weighted shortfall is 14 basis points on average, less than 10 basis points when HFTs leant against their orders, but 22 basis points when they traded with the order. In a regression analysis we show that this pattern is robust to adding standard control variables such as order size, order duration, volume, and volatility.

These findings should inform the debate on market structure. We believe the focus should shift from the bid-ask spread to end-user transaction cost.

P.S.1: The identified HFTs are: Citadel, Flow Traders, Getco, IAT, IMC, Knight, Optiver, Spire, Susquehanna, and Virtu. The institutional investors who provided order execution data are: APG, DNB, NBIM, and Swedbank Robur.

P.S.2: Please find a copy of the paper here. Slides are here.