In which market does information originate and, how does it flow?

This is not such an interesting question if there is a single national exchange. That exchange however no longer receives streams of buy and sell orders, but flocks of tourists interested in modern history. Trading has converged to a hybrid structure where customers and dealers trade bilaterally through electronic systems (and an occasional phone call) but also multilaterally through specialized electronic platforms (Johnson, 2010).

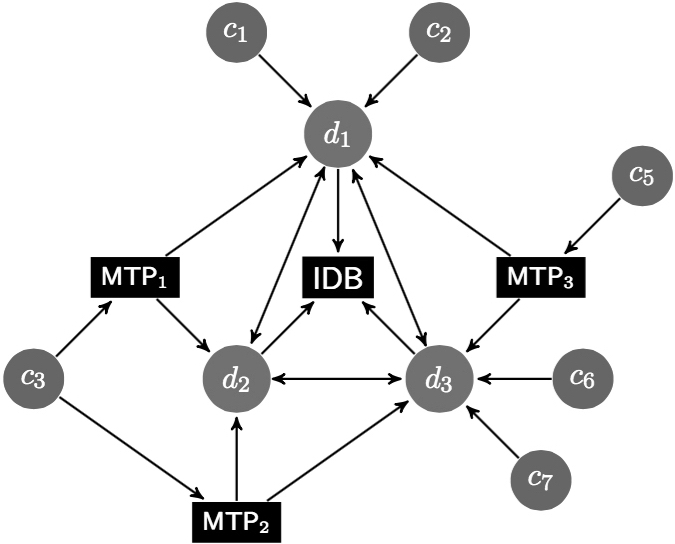

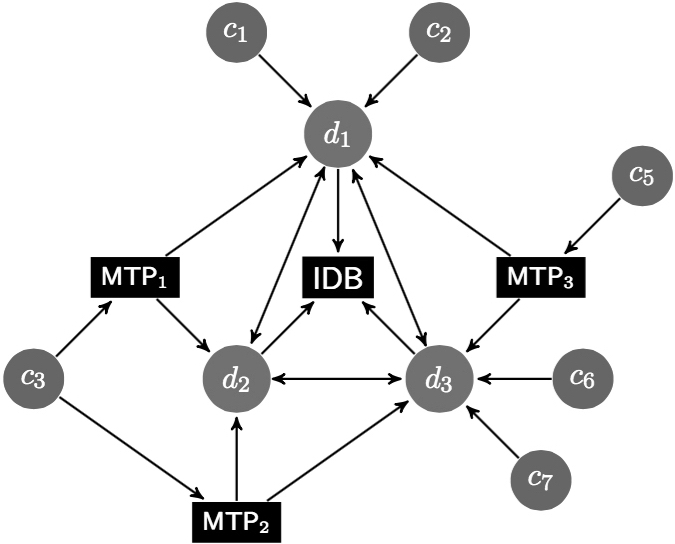

Darrell Duffie illustrated such market structure as follows in his keynote talk at the 2015 Econometric Society World Congress:

The graph shows how clients (c) connect to dealers (d) who trade through interdealer broker systems (IDBs), but both clients and dealers also trade through multilateral trading platforms (MTPs). In a way, each dealer, each IDB, and each MTP is a market.

Such strongly fragmented trading is a curse to regulators, and market participants more generally. Do trades go off at a fair price? Do some benefit as they become informed a bit earlier than others?

Alternatively, one could argue fragmentation is a blessing as one could theoretically track where information originates and how it “percolates” through the system. Instead of a single price series, a fragmented setting generates multiple price series (i.e., dealer prices, IDB prices, and MTP prices). Is there a dealer whose prices seem particularly/suspiciously well informed? How does his information transmit to other dealers? And, what is IDB’s role in price discovery?

We have the data, if only we had the tool. The beauty of electronic trading is that prices leave an audit trail (not true for dealers talking on an exchange floor). The only challenge is to identify information, and its flow. One natural approach is to track whether price changes in one market (e.g., a particular dealer’s quotes) are followed by price changes in another market (e.g., another dealer’s quotes). But, these price changes could be transitory and should then be considered “noise,” not information.

With Björn Hagströmer I took up the challenge to first identify information in price changes, and then analyze how such information flows across markets. In the end, we decided to extend the widely used and easily applicable framework of Hasbrouck (1995). We developed an approach to draw a network map of information “percolation.” The approach is quite general and can be implemented with standard software for any security that simultaneously trades in many markets.

We applied it to ultra high-frequency data on the euro Swiss franc exchange rate (EUR-CHF). The data contain individual other-the-counter (OTC) dealer quotes as well as EBS quotes (EBS is one of the largest IDBs in foreign exchange). Here is what we learned.

P.S.: Please find a copy of the paper here.