There will always be daredevils who ignore all signs, no? Well, the boy on the left seems to have second thoughts…

Unfortunately there are no warning signs by many of the liquidity pools that investors use to execute their orders. They need to judge by themselves whether these pools are deep enough to take a dive.

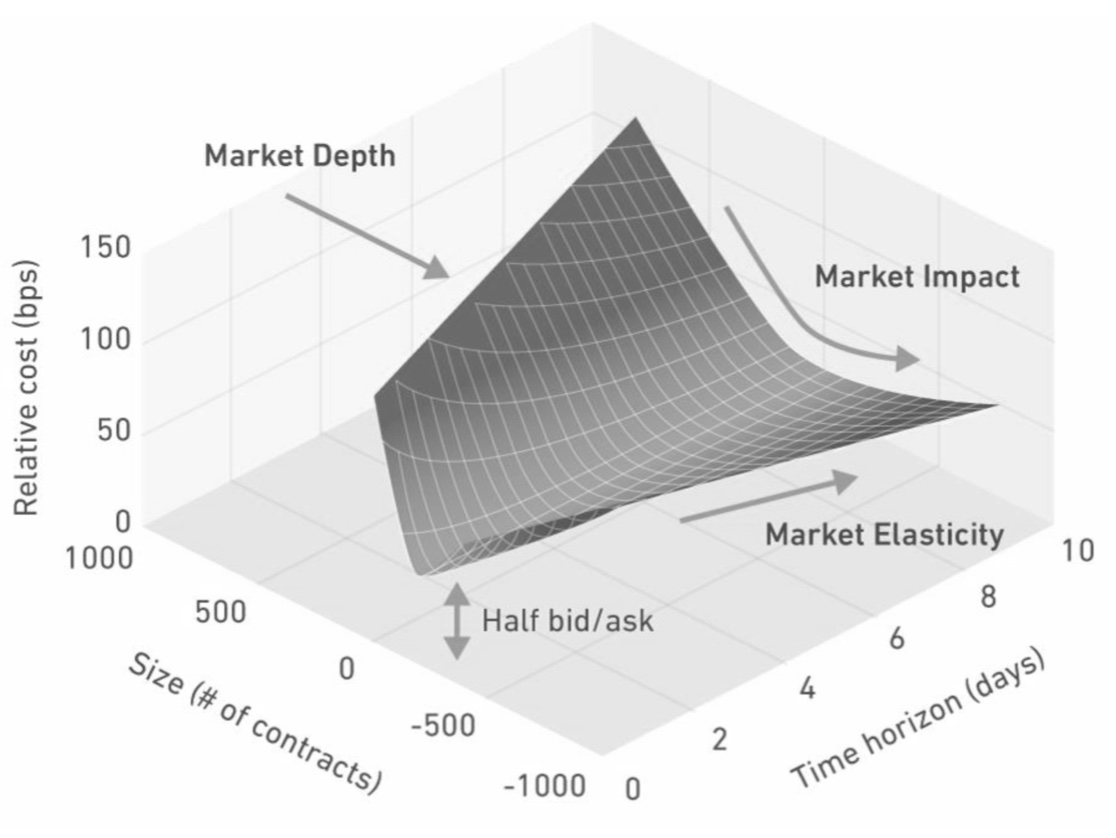

I would argue that the average investor has grown to a size where he would not take the dive. He would not send his entire order in at once. Well, he could but he would simply experience a large price impact and therefore high execution cost. Many industry professionals have emphasized that there is a time dimension to liquidity. Large orders should be split into smaller ones that are sent to the market over a particular time horizon to reduce price impact. MSCI, for example, coined the term Liquidity Surface: Price impact as a function of order size and time horizon. I plot their signature graph below.

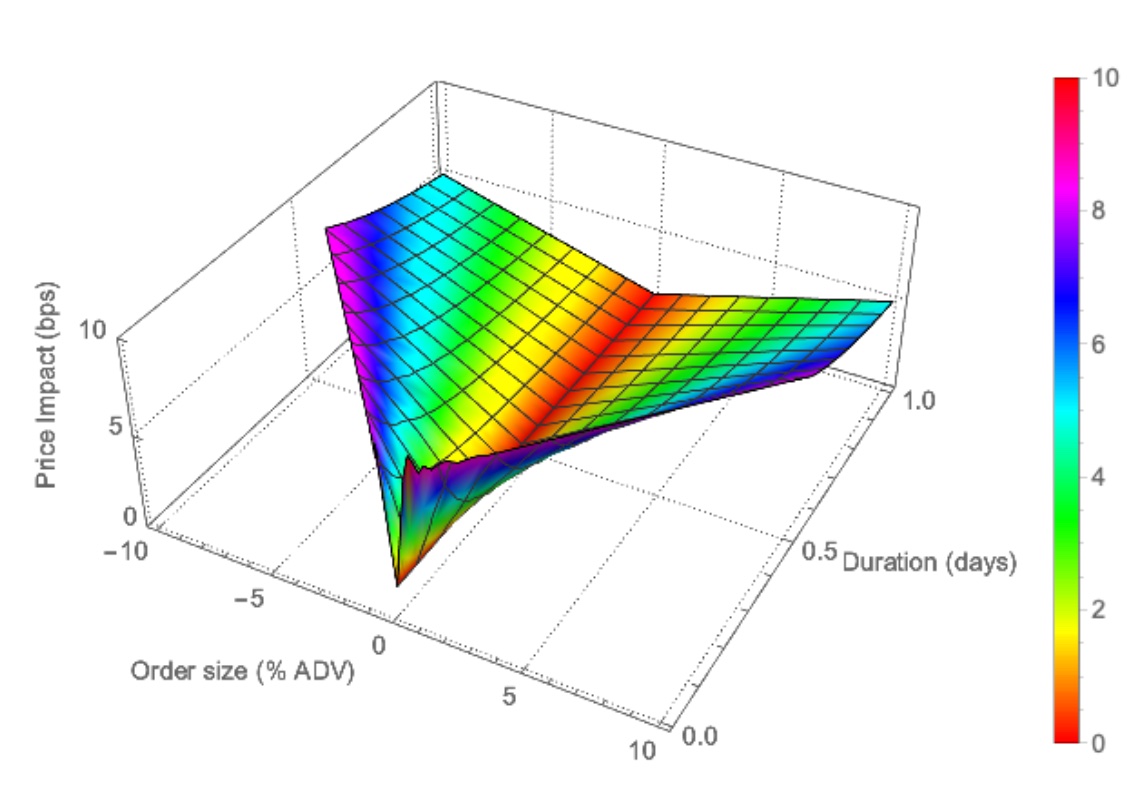

We came across this plot when working on our paper on strategic execution of large orders. In the paper we try to carefully model the optimal response of a set of competing market makers to a large order that is executed over a particular time horizon. We refer to such horizon as the duration of an order. The mathematics is challenging but we managed to find analytic solutions. With these solutions an investor could calculate what the price impact is for any size-duration pair as a function of

We calibrate our model to a sample of very actively traded stocks in a plain-vanilla equity market. With the results we are able to generate the following model-implied Liquidity Surface:

The benefit of this approach is that an investor does not need to dive in, break his neck a few times, and thus figure out how deep his pools are. He can make an educated guess based on his assessment of the various market parameters (i.e., the number of market makers, their risk aversion, etc.). He can therefore generate his own warning signs…

P.S.: The paper is with Agostino Capponi and Hongzhong Zhang of Columbia University (New York). Please find it here.