The gentleman is advised to keep a balanced portfolio: Liquid assets but also illiquid ones to avoid “compromising the overall performance of [his] portfolio.”

If you are a large investor the set of liquid assets might be smaller than you think. Or, at least, lots smaller than what it used to be a decade ago.

For the new version of our bid-price dispersion paper, Boyan Jovanovic (NYU) and I study a new dataset of bid prices in one of the most actively traded securities on Nasdaq: SPY, a popular exchange-traded fund (ETF) that tracks the S&P500. Hard to get a more liquid security than SPY, right?

Well…

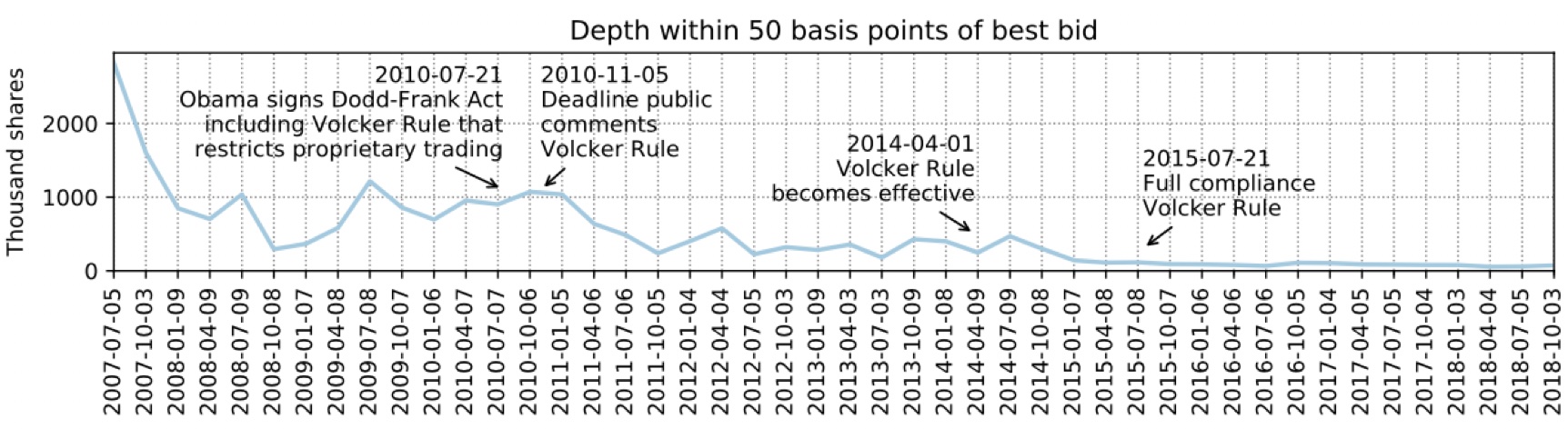

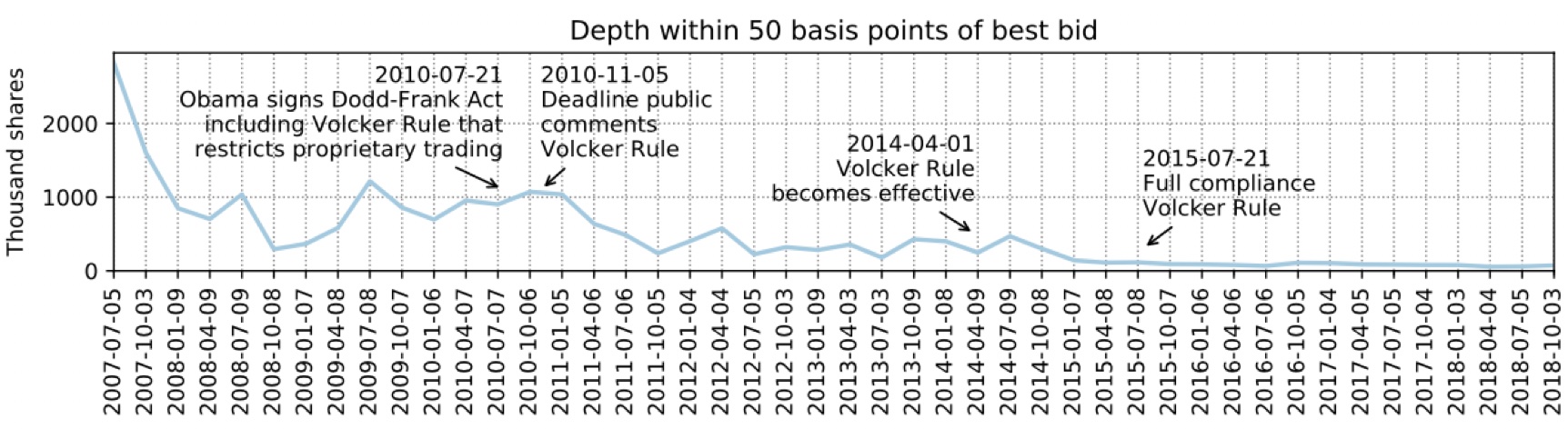

We downloaded Nasdaq order-book data spanning a decade of bid prices for SPY (available for academics at LOBSTERdata). There is no surprise in the bid-ask spread as it has been tight throughout the 2007-2018 sample (less than one basis point). What is striking however is the trend in depth. One of the most telling plots in the paper is how many shares of SPY are available within 50 basis points of the best bid (copied below).

Depth declined from more than 2 million shares in 2007 to less than 200,000 in 2018 (from $300 million to $60 million). We believe that this trend is at least partially due to the Volcker Rule that severely constrained sell-side banks from market-making activities.

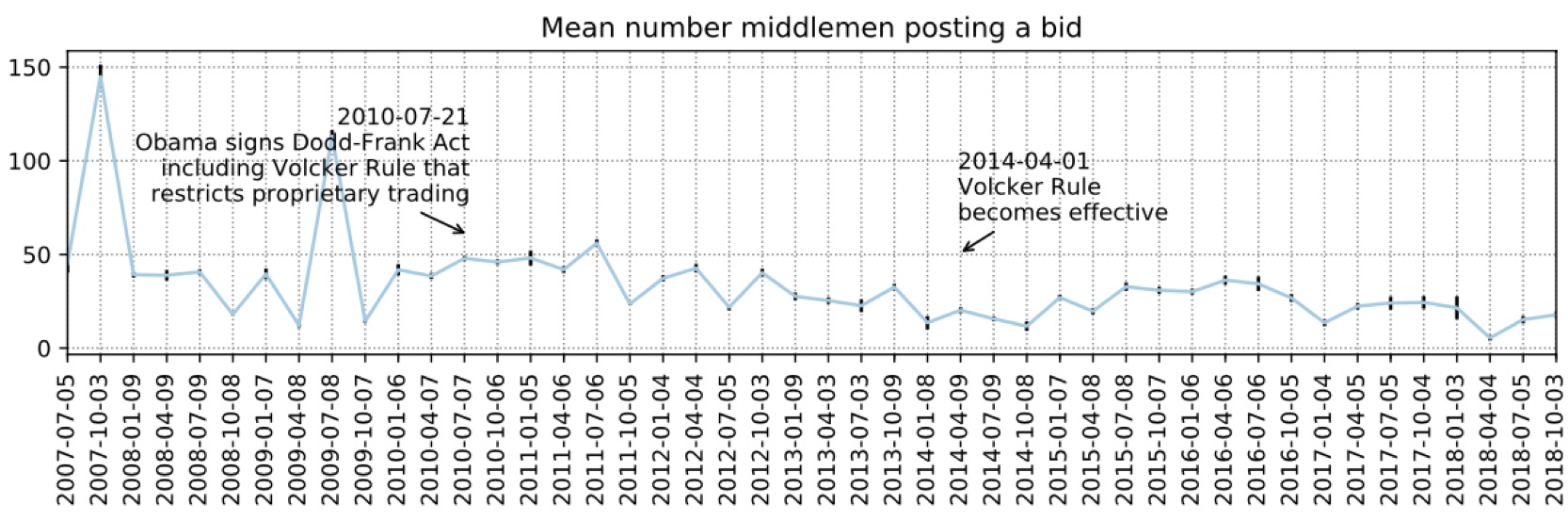

Another alarming trend we discovered is that this supply has become more erratic more volatile, more erratic. We propose a simple model that could generate such erratic supply endogenously with ex-ante homogeneous players. In equilibrium, players participate “randomly” and bid by drawing a price from a non-trivial bid-price distribution. The bidding is simultaneous and it is a nonzero bidding cost that generates the randomness. (Technically, the unique symmetric equilibrium is in mixed strategies.)

When estimating the model we find that the volatility of supply identifies the mean number of players in the market. The intuition is that the more volatile supply is, the fewer bidders participate on average. (A law-of-large-numbers type of intuition applies in the sense that with more (players) participating there is less variability in the mean.)

The estimation therefore provides an “educated guess” on how many (large) players participate in supplying liquidity for SPY. The plot below shows what we find (taken from the paper).

The estimates indicate that on average about 50 players participate at the start of the sample with only ten remaining at the end of it. Notably there is a substantial drop in the period where the Volcker rule was phased in.

Regulation does seem to matter, even in what supposedly is a perennially liquid security: SPY.

P.S.: My paper with Boyan Jovanovic (NYU) is here: Equilibrium Bid-Price Dispersion.

P.S. 2: It featured in FT and WSJ.