November 6, 2025

Large price jumps often make headlines. But what actually happens when prices move that much, that fast?

In a new paper, with coauthors Lucas Saru and Shihao Yu, I examine these “price dislocation” events in EuroSTOXX 50 futures. It is …

December 4, 2024

The VIX is often referred to as the fear gauge. But, what exactly do investors fear?

My conjecture is that it is the fear of forced selling. I propose a Grossman-Stiglitz type model to show that, indeed, VIX could be a gauge of fire sales.

The …

September 3, 2024

Regulators aim for transparency. In securities markets, they mandate publication of ever more data in the interest of investors.

But, who do they target in their zealous quest with ever larger heaps of data? Let us take the consolidated tape (CT) …

June 6, 2023

Technology makes almost everything reproducible these days. The voice of my father is reproducible. A scammer could call me with a machine, in real-time, converting his voice to my father’s: “My credit card fails and I need pay this …

February 13, 2023

In a recent visit to a local museum in my home town, two actors re-enacted an exchange between Albert Einstein and the local scientist Hendrik Lorentz, both Nobel Prize laureates (seated next to one another in the famous Solvay conference picture). …

November 16, 2022

In his 1889 book, Natural Inheritance, Sir Francis Galton takes particular interest in measuring variability. His writing is precise and inviting. Right from the start, he is focused on measuring variability. At some point, he declares his love …

November 30, 2021

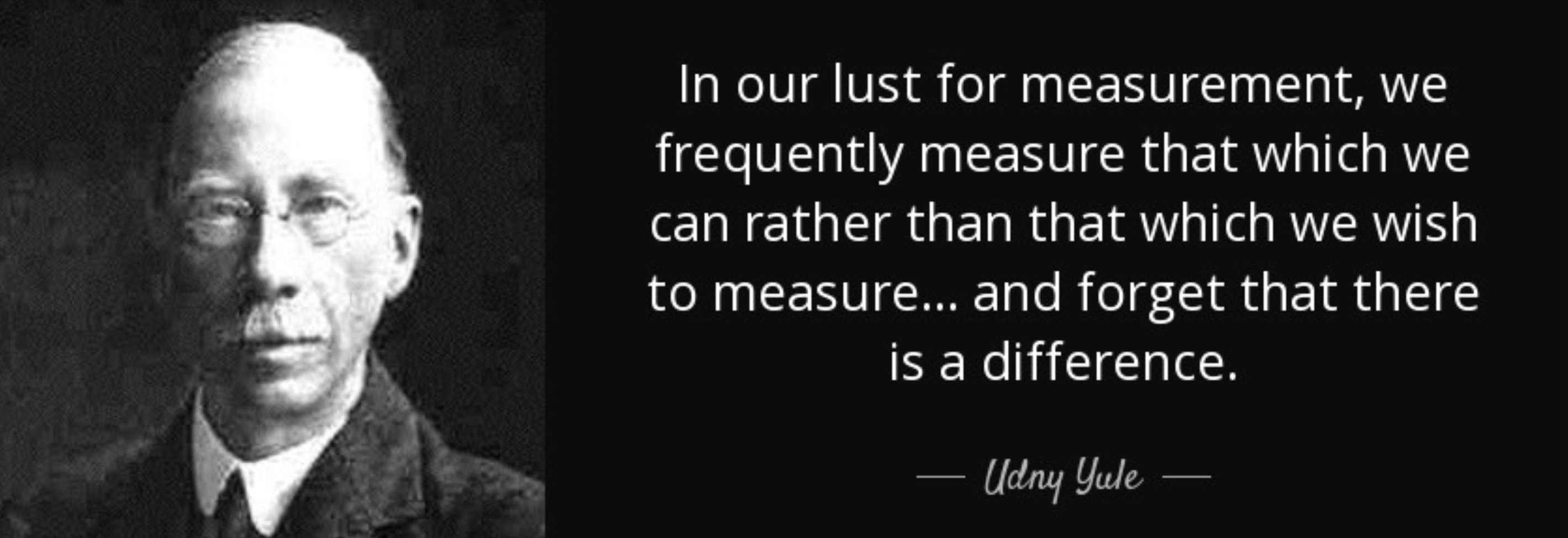

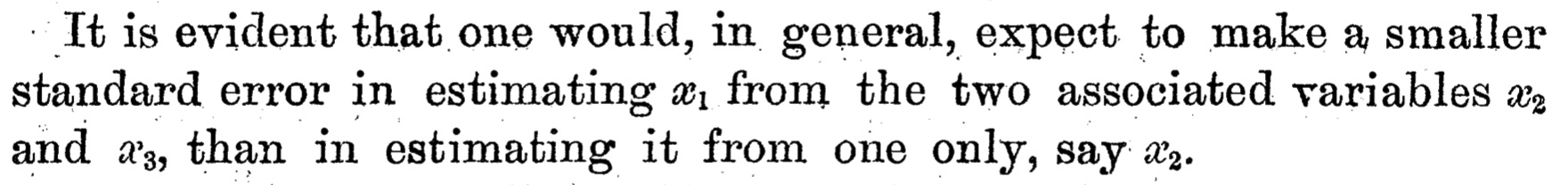

Estimates are inherently uncertain. In the late 1800s, the British statistician Udny Yule coined the term standard error to refer to such uncertainty. In 1897, he wrote:

He essentially says that with each additional data point, the uncertainty in …

April 23, 2021

This image reminds me of crossing the German border in my childhood days. Passport inspections slowed all of us down, resulting in traffic jams. This is the price we all paid for control by national authorities. Small for each household, but …

October 30, 2020

This is my crowd-sourced knowledge week for two reasons:

.

.December 6, 2019

The gentleman is advised to keep a balanced portfolio: Liquid assets but also illiquid ones to avoid “compromising the overall performance of [his] portfolio.”

If you are a large investor the set of liquid assets might be …

October 25, 2019

There will always be daredevils who ignore all signs, no? Well, the boy on the left seems to have second thoughts…

Unfortunately there are no warning signs by many of the liquidity pools that investors use to execute their orders. They need …

January 31, 2019

Increased intermediation has led to large institutional investors who occasionally demand liquidity beyond what a market can offer instantly. These investors resort to splitting their order to trade small (child) orders optimally through time, …

October 5, 2018

“What do you think of bitcoins? You are an economist, no? Is there any value to them?”

The conversation falls silent and all eyes turn in your direction. This undoubtedly is an all too familiar experience for many of us economists, …

August 1, 2018

Perhaps this blog post is.

Fake news. How do we tell information from merely gossip? How do we separate the wheat from the chaff? Or, closer to home, how do we know which dealer is most informed, and how the information is learned?

It has long …

September 26, 2017

Institutional investors and high-frequency traders can benefit from each other’s presence. This is the case when investors demand liquidity and HFTs supply it. This however is not the end of the story.

For some of their largest orders, …

August 16, 2017

Bidding is not gratis. In the old days, a bidder needed to stay around on the trading floor to wait for someone to “bite.” An economist would call this the opportunity cost of his time.

Bidding remains costly in modern markets, albeit …

May 17, 2017

Animals feel earthquakes a lot earlier than we do. It has been suggested that they respond to relatively mild P-waves that travel through the earth faster than the powerful S-waves that cause the severe shaking.

Prices seem to mildly vibrate …

December 16, 2016

Can central clearing parties (CCPs) weather a sudden storm?

CCPs were recently introduced for standard derivatives to remove counter-party risk from trades. Should the buyer or seller default, then the CCP will take over his trade commitment. CCPs …

November 25, 2016

The arrival of an electron microscope improved our vision by a factor of one million. Humans could finally see atoms.

I just released a short study on Nasdaq data that hopes to make a similar leap by studying trades at nanoseconds, a million times …

June 1, 2016

Today the Dutch regulator AFM published a study on high-frequency trading (HFT). They characterize it as a data driven assessment of HFT trading strategies.

In parallel, I released a survey of the academic literature on HFT. AFM kindly let me use …

April 26, 2016

In which market does information originate and, how does it flow?

This is not such an interesting question if there is a single national exchange. That exchange however no longer receives streams of buy and sell orders, but flocks of tourists …

June 18, 2015

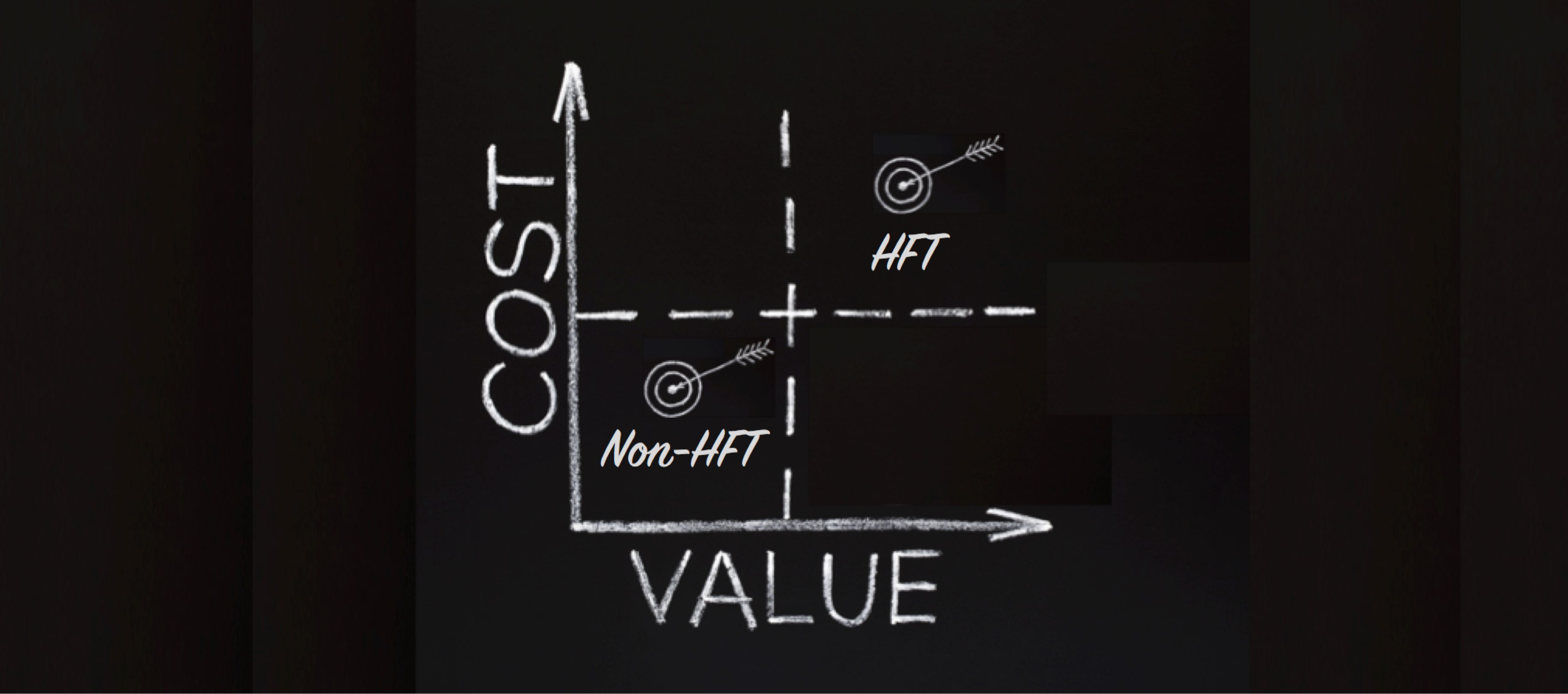

When high-frequency traders (HFTs) enter markets, the bid-ask spread declines. Several academic studies have reported such result. Investors pay less for each market order they send. All good and everyone happy.

Everyone?

Retail investors, …

February 24, 2015

I plead for a new, more general definition of liquidity suppliers in securities markets.

I propose

“He who trades against price pressures, supplies liquidity,”

instead of

“He whose price quote is taken by an incoming market order, …

October 16, 2014

Suppose you gave your girlfriend her favorite concert on her birthday. The cry of joy and the smile across her face. Irresistible.

But, you don’t have the ticket yet. You just created yourself a short position of a ticket, or two tickets …

July 7, 2014

It was in Thomas Sargent’s class at NYU that I first came upon the “want” operator. When complexity started to overwhelm, he would write “want” on the white board, followed by a colon.

Want: …

This way he would …

June 16, 2014

Albert Einstein famously doubted one of the implications of his quantum theory. He did not believe that information could be transmitted without moving the material to which it was attached. “Spooky action at a distance,” is what he …

May 28, 2014

Flash boys want flash markets. Exchanges invest to make their matching engines clock at ever higher speeds. High-frequency traders claim they can provide more liquidity as a result. Investors – the low-frequency traders in the market – …

April 8, 2014

Central clearing counterparties (CCPs) are particularly vulnerable if multiple traders collapse at the same time. One source of such risk is when trades crowd on a single security or risk factor. This risk is overlooked in standard CCP risk …